by Atish Bagrodia

What is Brexit?

On June 23rd, the United Kingdom will hold an in-out referendum on whether or not to stay within the European Union. In case the U.K. decides to withdraw from the EU, it will be a “British Exit” or Brexit.

What are the chances of Brexit?

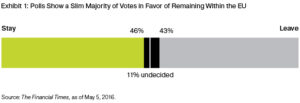

An aggregation of polls compiled by the Financial Times showed that, as of May 30th, the “Stay within EU” camp was ahead of the “Leave EU” by 3%. This is much lower than the 11% of voters who are still undecided and whom could potentially tip the scales in favor of the “Leave” camp.

What are the potential consequences of a Brexit?

Brexit poses a major challenge to the EU integration project. If the British referendum results in Britain’s exit, other countries within the EU that do not have the Euro as their common currency, such as Poland and Sweden, could start questioning the benefits of EU membership. Therefore, it is likely that the rest of the EU would make the exit process quite difficult.

The short-term consequences for the U.K. economy are likely to be negative, as more than half (52%) of British trade is with other EU countries. This could result in a loss of 3% or more in permanent gross domestic product.

What are the consequences for the U.S. and global financial markets?

In the short-term, a Brexit is likely to cause significant higher volatility and higher risk premiums in global financial markets. On the flip side, if the “Stay” camp prevails, there could be a mild relief rally and a reduction in risk premiums across the board.

It is also likely that the British referendum could weigh heavily on the minds of the U.S. Federal Reserve at their June 14-15 meeting. The impending vote may also influence the Fed to take a cautionary stance and refrain from raising interest rates.