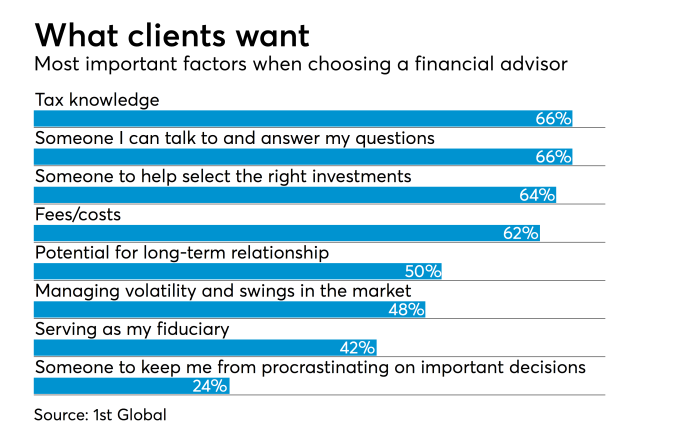

Tax knowledge is considered to be the most important factor when choosing a financial advisor, according to a new survey, which also found the CPA credential to be the one most associated with financial advice.

The survey, from 1st Global, a wealth management firm that works with CPAs, found that 66 percent of affluent and emerging affluent consumers view tax knowledge as the most important factor when choosing a financial advisor. In addition, 47 percent of the respondents associated the CPA designation with financial advice, the largest of any designation included in the study. For the study, 1st Global and PopResearch polled 300 respondents with $150,000 or more in assets.

The report, “Investors, CPAs and Tax-Focused Financial Advice,” found that even though 53 percent of the survey respondents currently work with a CPA or accountant, tax-aware advice is still a key concern for them. Tax-optimized investing (58 percent), estate tax planning (45 percent) and tax burden reduction (45 percent) ranked as the top three specialties the investors who were surveyed said they seek when choosing a financial advisor.

The respondents were asked about other credentials as well, including Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), Chartered Financial Consultant (ChFC), Certified Investment Management Analyst (CIMA) and Personal Financial Specialist (PFS), but the CPA came out on top. “CPAs were ranked first,” said 1st Global president David Knoch. “They actually ranked 50 percent higher than CFPs. The survey asked people to see if they could recognize professional certifications and licenses to see if they could associate them with the provision of financial advice. The one they recognized the most 47 percent of the time was CPAs. CFAs actually came in second at 40 percent. CFPs were third at 30 percent, and 27 percent of people said they didn’t recognize any of them. And then 7 percent recognized ChFC and CIMA, and only 4 percent recognized the PFS designation, so the CPA designation was the most recognized of survey respondents.”

Trust was considered to be more important to investors than skills or knowledge, with 90 percent of the survey respondents defining a trusted advisor as someone who had their best interest in mind. Only 10 percent named skills or knowledge as important.

“There has been a public policy debate around how financial advisors should practice,” said Knoch. “We don’t often get into the headlines about how financial advisors are compensated and levels of service, and the way to regulate it. It’s usually too boring for anyone to be talking about, but it’s actually been in the headlines more recently. The idea of the DOL’s [Department of Labor’s] fiduciary rule for financial advisors we think has more investors asking the question, ‘How is my advisor serving me and what is their responsibility to me?’ I think it’s bringing up questions that investors may not have thought to ask.”

Despite growing access to digital interactions and information, face-to-face discussions continued to be important to the survey respondents, with 57 percent ranking face-to-face interactions as very or extremely important to them.

“Well more than half of the survey’s respondents felt like it was either very or extremely important to meet face to face with the person giving them advice,” said Knoch.

The majority of respondents indicated they would discuss investments and long-term financial aspirations with their CPA or accountant, and 74 percent said they were somewhat or extremely comfortable doing that.

The survey also revealed some generational differences, with younger generations seeking financial advice from professionals more than Baby Boomers. More than 60 percent of respondents in Generation X and Generation Y said they have a CPA and a financial advisor. In addition, younger respondents with a CPA were 6 percent more satisfied with their financial advisors.

“Gen X and millennial individuals are much more interested in becoming an educated participant in the process rather than merely delegating,” said Knoch. “The delegation behaviors are actually very boomer like. Integration behaviors are much more Gen X and millennial like. That does speak to Gen X and millennials hiring financial advisors more than their boomer counterparts, and in fact some other surveys have shown that to be the case. Gen X and millennials are hiring financial advisors more often than their boomer counterparts.”

CPAs could be losing out by not targeting younger clients with financial advice, according to the survey results, which found many people just doing it for themselves. “It was also interesting in this survey, as we talk about younger clients, of the 31 to 35 age cohort, 64 percent of those who had a CPA also had a financial advisor,” said Knoch. “In fact, out of the entire thing, 38 percent used a CPA, and of those, 56 percent used a financial advisor. For those who did not use a CPA, 72 percent of them did not have a financial advisor, so there was a have and have not element here. People who were involving expert professionals in their lives tended to have expert professionals that would help them work on both taxes and investments. They chose not to bring a CPA into their life. They appeared to be much more of a do it yourself-er when it came to getting financial services.”

Many investors are looking for tax-optimized investing strategies, especially in the wake of the new tax law, although the survey didn’t ask specifically about the Tax Cuts and Jobs Act. But there’s more opportunity for CPAs to offer such services in the context of the tax overhaul.

“What was interesting in this is that tax-optimized investing was the most selected category that these investors were looking for,” said Knoch. “It was interesting that while they seemed to be seeking tax-optimized advice, you have a number in this group that are not actually hiring CPAs or financial advisors to do that. Therein we think lies a tremendous opportunity for the CPA professionals in America today who may not be serving as financial advisors. Frankly speaking, a CPA who is not in the wealth management profession today, this survey is saying clearly right now is the time to start. These people answering this survey, 62 percent, more than any other, agreed that CPAs have the ethical standards and skills needed to serve a family’s needs.”

With 58 percent of the survey respondents seeking tax-optimized investing strategies, Knoch believes American families are looking for these services from CPAs. “For the firms that are already offering wealth management,” he said, “we think now is the time to ask the question: ‘Are we playing at our best?’ The demand for these services from CPA firms may never have been higher since CPAs started offering financial services three or four decades ago.”